Sacrifice: the destruction or surrender of something for the sake of something else; something given up or lost

Sacrifice is the word that comes to mind when I think about how I paid off 25K in just 11 months. What did I actually have to sacrifice to meet such a goal, you may wonder? I had to sacrifice my time, my sleep, my body and the art of buying stuff (aka my shopping habit).

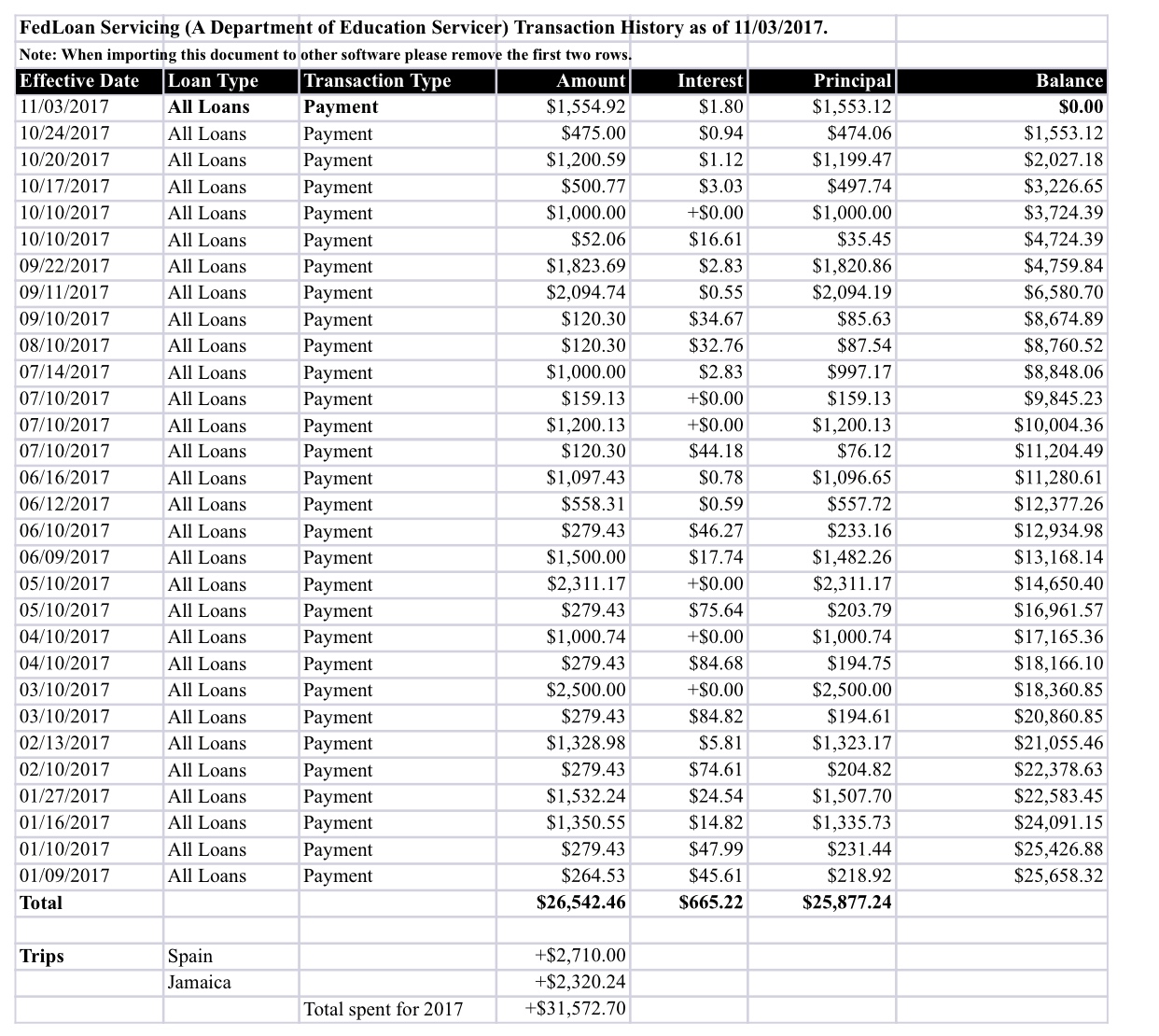

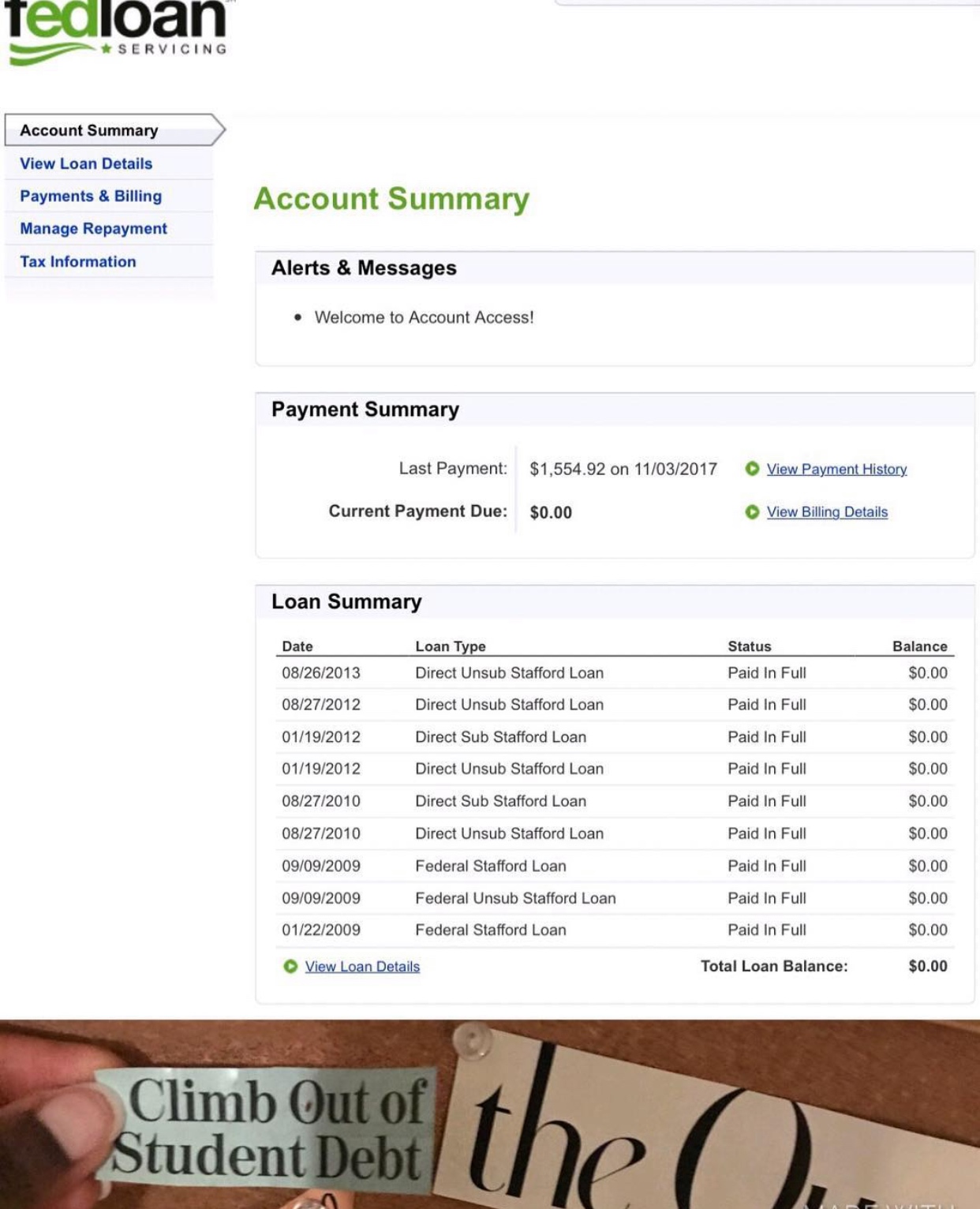

I graduated from Temple University in 2011 with a Bachelor’s Degree in Health Information Management and earned my Master’s Degree in Health Administration from Saint Joseph’s University in 2014. The bulk of my student loan debt was from my graduate degree. January 9, 2017, I had a total of $25,658.32 in student loan debt.

I decided that it was time to pay off these loans because the hubby and I were looking to purchase a home and I did not want to add a disproportionate amount to our debt-to-income ratio. Secondly, when I called FedLoan Servicing to see if I could have my loans deferred, so we could pay for our wedding, I was told that if we decided to file our income taxes jointly my monthly payments would increase because my husband’s salary would be included. I did not think it would be fair for my husband to pay for my student loans, so that’s when I knew I had to buckle down and focus if I wanted to achieve this goal.

We got married in 2015 and I had a few career changes within the first 6 months of our marriage that made it almost impossible for me to even fathom such a goal. It wasn’t until I landed my second Director of Health Information Management position in November 2016 that I saw this as an opportunity to FINALLY pay off my student loan debt. It was during this time that I contemplated getting a second job in retail. It just so happened that the local supermarket 5 minutes away from my job was having a National Hiring Day, and since I had years of retail experience and a knack for exceptional customer service I thought, “Why not?”

Herein comes the sacrificing of my time, my precious sleep and body. Between my 9-5 and the supermarket I worked 7 days a week. At the supermarket, I worked two, 5-hour shifts per weeknight (leaving from one job and going straight to the other) and 8-hour shifts every Saturday and Sunday until my loans were paid off. It was nothing but the grace of God that allowed me to do this.

I had tunnel vision when it came to paying my loans off. My husband and I sacrificed our joint savings goal that year. We discussed with our financial advisor, Bernard Hamilton, that our strategy was to pay our bills as per usual, the monetary wedding gifts we received would serve as our emergency fund, and once my student loan debt was paid off we would kick our savings plan into high gear. We did just that and it worked! Once our monthly bills were paid I put EVERY EXTRA DOLLAR that I had towards the student loan debt. The crazy part is that my bestie and I traveled to Spain and Jamaica that same year to celebrate our 30th birthdays. Besides the exhaustion, and back and foot aches from standing on my feet 8 hours a day, it was all worth it. Worth it so much that I currently still work at that supermarket even though I CRUSHED my goal 3 years ago! That and because my financial advisor will NOT let me quit (insert Kanye shrug).

5 Tips to pay off student loan debt

- Have a plan – get a pen and pad and think about how much money you need to put towards your loans per month to pay them off by your personal deadline.

- Sign up for autopay to save on interest.

- Pay the loan with the highest interest rate first.

- All additional payments outside of your automatic monthly payment should be distributed to the principal only – Go online and put it directly to the principal, if you do automatic withdrawal it will be applied to both the principal and the interest and that is a NO NO when the goal is to pay them off ASAP.

- Buckle down, stay focused and before you know it, you’ll be like “I DID THAT!”

Leave a comment below! Do you have student loans? Do you have a plan on how you’ll pay them off? What’s stopping you from getting out of your student loan debt?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.